If you are looking for What is Book Value? – YouTube you’ve came to the…

Month: September 2023

Uncategorized

Continue Reading

fair market value vehicle How do you calculate the fair market value of a vehicle?

If you are searching about Fair Market Value (FMV): Formula and Calculation you’ve visit to…

Uncategorized

Continue Reading

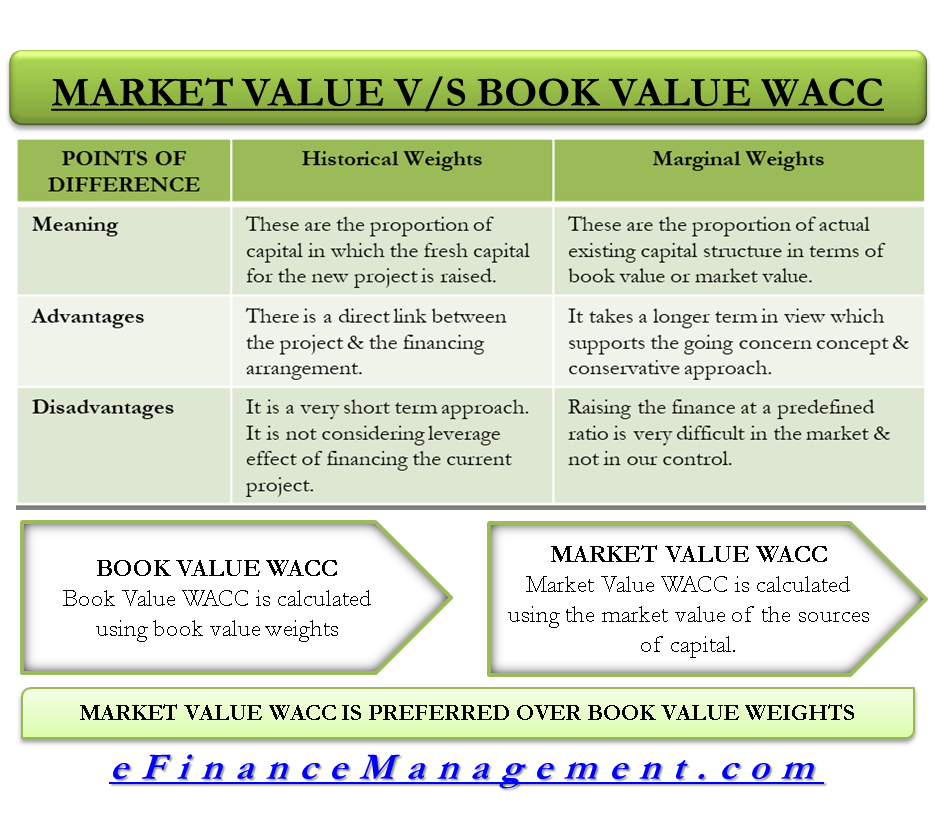

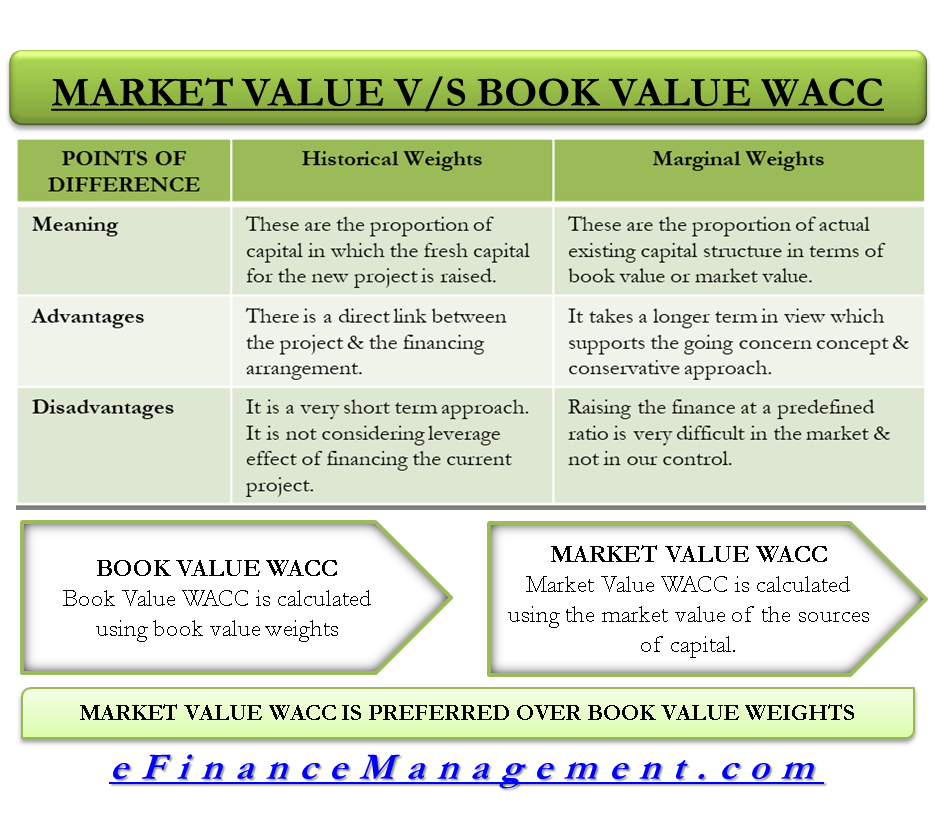

property tax assessment vs market value Intro to understanding assessed value, taxes and market value

If you are looking for Property Tax Guide 2023 – Calculation, Types & Online Payment…

Uncategorized

Continue Reading

stock market value today Dow rises for the fourth time in five days, ekes out record closing

If you are looking for Stock market today: Live updates on the Dow, S&P 500,…

Uncategorized

Continue Reading

value fresh market Rebates promotions

If you are searching about Fresh Value Produce (@ProduceValue) | Twitter you’ve came to the…

Uncategorized

Continue Reading

fair market value calculator Fmv calculator online

If you are searching about goodwill you’ve came to the right page. We have 35…

Uncategorized

Continue Reading

car fair market value What is the fair market value of my car?

If you are searching about 3 Ways to Determine the Fair Market Value of a…